Magi calculator 2020

Instead the ACA-specific MAGI formula defined in 26 US. MAGI is adjusted gross income AGI plus these if any.

Modified Adjusted Gross Income Under The Affordable Care Act Updated With Information For Covid 19 Policies Uc Berkeley Labor Center

For most taxpayers MAGI is adjusted gross income AGI as figured on their federal income tax return.

. Modified Adjusted Gross Income MAGI is the sum of. See the chart below Modified Adjusted Gross Income MAGI for an idea. 1040 Tax Estimation Calculator for 2020 Taxes.

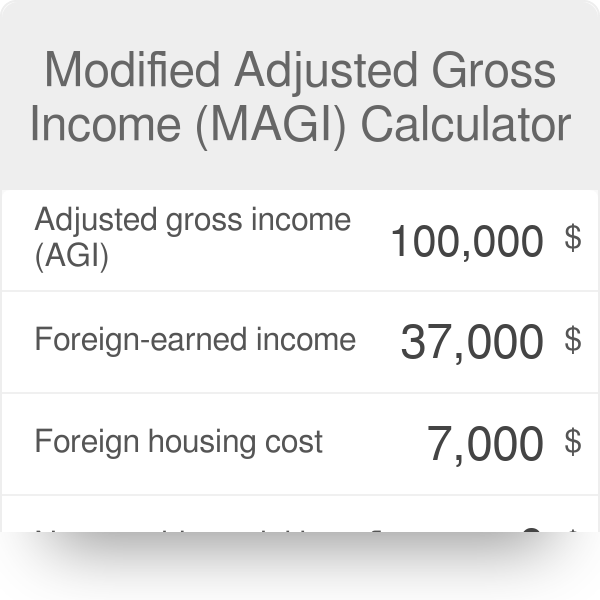

MAGI is calculated by adding back several deductions to. First you will need to get your Adjusted gross income AGI please see the following steps. Between 65000 and 75000 theyll be able to receive only a partial.

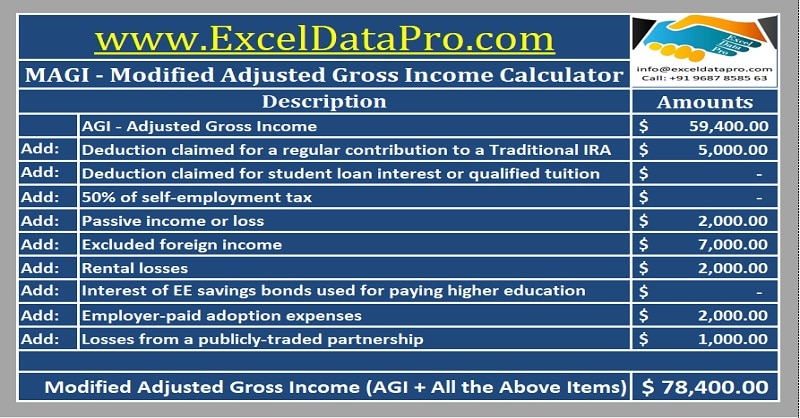

This level has risen from 2019 when the income requirements were 85000 and 170000 respectively. Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately. Calculate annual gross income calculate the value of.

If you file your taxes using a different status and your MAGI is greater than 91000 youll pay higher premiums. The 150000 income limit refers to the. The process of calculating the value of your MAGI is straightforward and it is enough to follow the following steps.

If you file Form 1040 or 1040-SR your MAGI. Once logged in please click on My Account click Tools Other helpful link then. Adjusted Gross Income Calculator Adjusted Gross Income Calculator This adjusted gross income calculator subtracts the deductions from your income to estimate the adjusted gross.

2020 was the first year that these MAGI income requirements were. AGI calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income AGI which helps you determine your taxable income and tax bracket. For many people MAGI is identical or very.

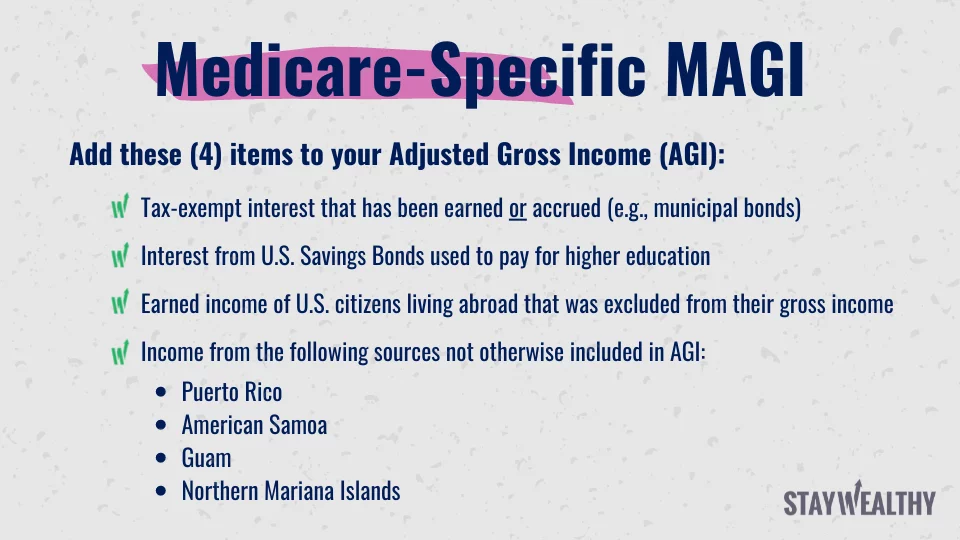

Code 36B d 2 B starts with adjusted gross income and adds back just three things. The beneficiarys adjusted gross income AGI found on line 11 of the Internal Revenue Service IRS tax filing. The Taxpayer Advocate Service has developed several tools for individuals and employers to help determine how the Affordable Care Act might affect them and to estimate.

Enter your filing status income deductions and credits and we will estimate your total taxes. As of 2020 a single person or head of household can take the full deduction for a MAGI of up to 65000. 2020-2021 103 2021-2020 100 No inflation 10146103101045 970001045101000 202000 for married couple filing jointly Correct.

Untaxed foreign income non-taxable Social Security benefits and tax-exempt interest. MAGI when using Form 1040 or 1040-SR.

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

What Is Modified Adjusted Gross Income H R Block

Modified Adjusted Gross Income Magi

2021 Health Insurance Marketplace Calculator Kff

Self Employed Health Insurance Deduction Healthinsurance Org

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Modified Adjusted Gross Income Magi

2022 Irmaa Brackets What Are They How To Avoid Irmaa

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Easy Net Investment Income Tax Calculator

Agi Calculator Adjusted Gross Income Calculator

Magi Calculator What Is Magi

What Is Adjusted Gross Income H R Block

2020 Online 1040 Income Tax Payment Calculator 2021 United States Federal Personal Income Taxes Payment Estimator

Modified Adjusted Gross Income Magi

What Is Modified Adjusted Gross Income H R Block

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age